Fun with Money: Making Finances Engaging

Fun with money? It might sound like an oxymoron, but it’s a concept that’s gaining traction. We’re all taught the importance of financial literacy, but often the methods used to instill these lessons can feel dry and tedious. What if learning about money could be as enjoyable as playing a game, as rewarding as pursuing a passion, or as entertaining as watching a movie?

This blog post explores innovative ways to make finances more engaging for people of all ages. We’ll delve into the world of money management games, discover creative ways to earn money, and even explore the realm of financial entertainment.

Get ready to turn your perception of finances on its head, because learning about money doesn’t have to be a chore – it can be a fun and rewarding journey.

Budgeting Challenges & Rewards

Budgeting is a crucial aspect of financial well-being, helping us manage our money effectively and achieve our financial goals. It can be challenging at times, especially when faced with unexpected expenses or temptations to spend beyond our means. However, the rewards of successful budgeting are significant, including financial stability, peace of mind, and the ability to pursue our dreams.

Sometimes, finding fun with money means getting creative with your spending. Instead of buying another expensive hair bow, why not put that money towards a DIY project? You can find some amazing ideas for hair bow holders online, like these 7 ideas for hair bow holders that are both stylish and budget-friendly.

Not only will you save money, but you’ll also have a unique and personalized way to store your hair accessories. It’s a win-win situation, and that’s what fun with money is all about!

Budgeting Challenges & Rewards

Budgeting challenges often arise from factors such as unexpected expenses, impulsive spending, and a lack of financial literacy. These challenges can make it difficult to stick to our budget and achieve our financial goals. However, by understanding these challenges and implementing effective strategies, we can overcome them and reap the rewards of successful budgeting.

Who says fun with money has to involve big spending? Sometimes, the most memorable moments are built on shared experiences and traditions. For us, that means creating a magical Christmas morning filled with laughter and excitement. We’ve learned that frugal fun family traditions can be just as special as expensive ones, and it’s the time spent together that truly matters.

After all, isn’t the joy of giving and receiving what makes the holidays so special?

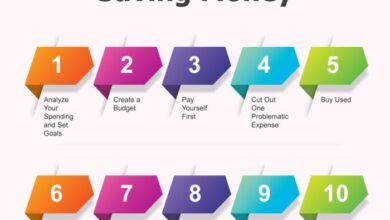

Fun Budgeting Challenges

A fun budgeting challenge can motivate individuals to save and spend wisely. One such challenge is the “52-Week Savings Challenge.” This challenge involves saving a progressively increasing amount each week, starting with $1 in the first week and increasing by $1 each subsequent week.

Saving money can be fun, especially when you’re thinking about your little one’s space. If you’re looking for inspiration on how to create a cool and cozy room for your toddler boy without breaking the bank, check out this fantastic resource on toddler boy room on a budget 2.

It’s packed with clever ideas and budget-friendly solutions, so you can create a space that’s both stylish and affordable. You’ll be amazed at how much fun you can have with money when you get creative!

By the end of the year, you will have saved $1,378. This challenge encourages discipline and consistency in saving, making it a fun and rewarding way to reach a substantial savings goal.

Rewards for Achieving Financial Goals

Rewards play a significant role in motivating individuals to achieve their financial goals. Setting realistic goals and associating them with specific rewards can make the journey more enjoyable and rewarding. Here are some examples of rewards for achieving financial goals:

- Paying off debt:Reward yourself with a vacation or a new gadget.

- Reaching a savings goal:Treat yourself to a dinner at your favorite restaurant or a shopping spree.

- Investing in a retirement account:Celebrate your progress with a weekend getaway or a new hobby.

Gamification for Budgeting

Gamification can effectively motivate individuals to stick to their budgets and track progress. By incorporating game-like elements into budgeting, it becomes more engaging and fun. Here are some ways to gamify your budget:

- Use budgeting apps:Many budgeting apps offer features like progress bars, challenges, and rewards, making budgeting more interactive and engaging.

- Set financial goals and track progress:Visualizing progress toward financial goals can be motivating and encourage individuals to stay on track.

- Reward yourself for good budgeting habits:Celebrate small wins and acknowledge your efforts in sticking to your budget.

Financial Literacy for Kids

Teaching children about money is crucial for their future financial well-being. It helps them develop essential skills like saving, spending, and understanding the value of money. Starting early allows them to build healthy financial habits that will benefit them throughout their lives.

Children’s Story with Financial Concepts

This story illustrates the importance of saving and the power of compounding.Once upon a time, there was a little girl named Lily who loved collecting colorful pebbles. Every day after school, she would search the park for the most beautiful and unique pebbles.

One day, her grandmother, a wise and kind woman, told Lily, “Every time you find a pebble, save half of them in a special box.” Lily was a little hesitant at first, but she trusted her grandmother and started saving.As weeks turned into months, Lily’s pebble collection grew.

She noticed that her savings box was filling up faster than her collection box. Her grandmother explained, “The more you save, the more you have to save with. It’s like magic!” Lily was amazed. She learned that by saving, she was not only accumulating pebbles but also growing her savings.Years later, Lily grew up and became a successful businesswoman.

She used the same principle of saving and investing that her grandmother taught her. She understood the power of compounding and the importance of financial planning. Lily’s journey reminds us that even small acts of saving can lead to great rewards in the future.

Activities and Games for Teaching Financial Literacy

Engaging children in activities and games can make learning about money fun and memorable.Here are some activities and games:

- Piggy Bank Challenge:Encourage children to save their allowance or earnings in a piggy bank. Set a goal for them to reach, like saving enough for a toy or a trip. This teaches them the value of patience and delayed gratification.

- Money Matching Game:Create cards with different denominations of money (coins and bills). Children can match the cards based on their values. This helps them learn about different denominations and their worth.

- Shopping Simulation:Use play money and toy groceries or other items to create a mock shopping experience. Children can practice budgeting, making choices, and calculating change.

- Charitable Giving:Discuss the importance of giving back to the community. Children can donate a portion of their allowance or earnings to a cause they care about. This teaches them the value of generosity and social responsibility.

Everyday Situations for Introducing Financial Literacy

Incorporating financial literacy into everyday situations can make it more relatable and practical for children.Here are some examples:

- Grocery Shopping:Involve children in the grocery shopping process. Discuss the budget, compare prices, and help them choose affordable options. This teaches them about budgeting and making informed decisions.

- Chores and Allowance:Connect chores with earning an allowance. This helps children understand the value of work and the concept of earning money. It also teaches them about responsibility and contributing to the household.

- Saving for a Goal:Encourage children to save for specific goals, like a new book, a video game, or a family vacation. This teaches them about planning, setting priorities, and the satisfaction of achieving their goals.

Financial Entertainment: Fun With Money

Financial entertainment encompasses a wide range of media that can teach us about money, investing, and personal finance in an engaging and entertaining way. From movies and books to podcasts and video games, these forms of entertainment can provide valuable insights and lessons, making the often-dry world of finance more accessible and relatable.

Examples of Financial Entertainment

Financial entertainment can take many forms, each offering unique perspectives and lessons. Here are some examples:

- Movies:Movies like “The Wolf of Wall Street” and “The Big Short” offer a glimpse into the world of finance, showcasing both the excitement and the risks involved. While these films may not always provide accurate portrayals, they can spark conversations about financial topics and raise awareness of different financial concepts.

- Books:Books like “Rich Dad Poor Dad” by Robert Kiyosaki and “The Intelligent Investor” by Benjamin Graham provide practical advice and insights into personal finance and investing. These books can be valuable resources for those seeking to improve their financial literacy and make informed decisions.

- Podcasts:Podcasts like “Planet Money” and “The Tim Ferriss Show” offer engaging discussions on a wide range of financial topics, from personal finance to investing and entrepreneurship. These podcasts can provide a convenient way to learn about financial matters while commuting or doing other activities.

- Video Games:Video games like “SimCity” and “Stock Market Game” allow players to simulate real-world financial scenarios, providing hands-on experience in managing budgets, investing, and making financial decisions. These games can be a fun and interactive way to learn about financial concepts.

Impact of Financial Entertainment on Financial Literacy and Behavior, Fun with money

Financial entertainment can play a significant role in shaping our understanding and behavior towards money. It can:

- Increase Financial Literacy:By exposing viewers, readers, and listeners to financial concepts, entertainment can raise awareness and stimulate interest in learning more about personal finance.

- Inspire Financial Goals:Seeing successful characters achieve financial goals in movies or books can motivate viewers to set their own financial aspirations.

- Promote Financial Responsibility:Stories that depict the consequences of poor financial decisions can serve as cautionary tales, encouraging viewers to make responsible choices with their money.

- Demystify Financial Concepts:Entertainment can present complex financial concepts in a more accessible and relatable way, making them easier to understand and apply.