Trump Tariffs Canada Mexico Impact on All Three

Trump tariffs Canada Mexico impact on all three nations. This complex issue touched on trade policies, economic repercussions, and political relations, reverberating through various sectors. The tariffs imposed by the Trump administration significantly altered the economic landscape, prompting a wave of reactions and adjustments across borders. This exploration delves into the specifics of the tariffs, analyzing their impacts on the US, Canada, and Mexico, and examining the potential long-term consequences.

The tariffs, encompassing specific product categories, aimed to influence trade dynamics. This analysis considers the rationale behind these actions and the subsequent effects, from potential job losses and gains to shifts in international trade relations. Understanding the intricate interplay of economic forces is crucial to evaluating the long-term implications of these trade policies.

Introduction to Tariffs

Source: turner.com

Tariffs are taxes imposed on imported goods. Their primary purpose is to protect domestic industries from foreign competition and generate revenue for the government. By increasing the price of imported goods, tariffs make domestically produced goods more attractive to consumers. This mechanism aims to stimulate domestic production and employment. However, tariffs can also have unintended consequences, including retaliatory measures from other countries and negative impacts on consumers through higher prices.Tariffs operate by adding a specific amount (specific tariff) or a percentage (ad valorem tariff) to the price of imported goods.

The mechanics involve customs officials collecting the tariff at the point of entry into the country. This process is crucial in regulating international trade and ensuring compliance with trade agreements. The impact of tariffs extends beyond the immediate transaction, affecting supply chains, global markets, and even political relations.

Types of Tariffs

Tariffs are categorized into various types based on how they are calculated. Ad valorem tariffs are calculated as a percentage of the value of the imported good. A 10% ad valorem tariff on a $100 item adds $10 to the price. Specific tariffs are levied at a fixed rate per unit, regardless of the value. For example, a $5 specific tariff on each imported television, regardless of its price.

These different types have distinct implications for importers and consumers. The choice of tariff type often reflects policy objectives and the specific characteristics of the imported goods.

Historical Context of Tariffs

Historically, tariffs have played a significant role in shaping international trade. From protectionist policies in the early 20th century to the rise of free trade agreements in the latter half of the 20th century, tariffs have been a central element in global economic relations. The Smoot-Hawley Tariff Act of 1930, for example, is often cited as a contributing factor to the Great Depression.

This act significantly raised tariffs on imported goods, triggering retaliatory measures from other countries and worsening the global economic downturn.

Basic Economic Concepts Related to Tariffs, Trump tariffs Canada Mexico impact on all three

| Concept | Definition/Explanation | Example |

|---|---|---|

| Protectionism | Economic policy aimed at protecting domestic industries from foreign competition. | Imposing tariffs on imported steel to support domestic steel mills. |

| Import Substitution | Replacing imports with domestically produced goods. | Promoting the production of textiles in a country to reduce reliance on imported clothing. |

| Revenue Tariff | Tariffs levied primarily to generate government revenue. | Tariffs on imported luxury goods. |

| Deadweight Loss | Loss of economic efficiency that occurs when the free market is not allowed to operate. | Consumers paying higher prices for goods due to tariffs, reducing their purchasing power. |

| Comparative Advantage | The ability of a country to produce a good or service at a lower opportunity cost than other countries. | A country specializing in producing agricultural products due to favorable climate and resources. |

This table highlights the key economic concepts related to tariffs and their potential effects. Each concept is essential to understand the complex interplay of domestic and international economic forces.

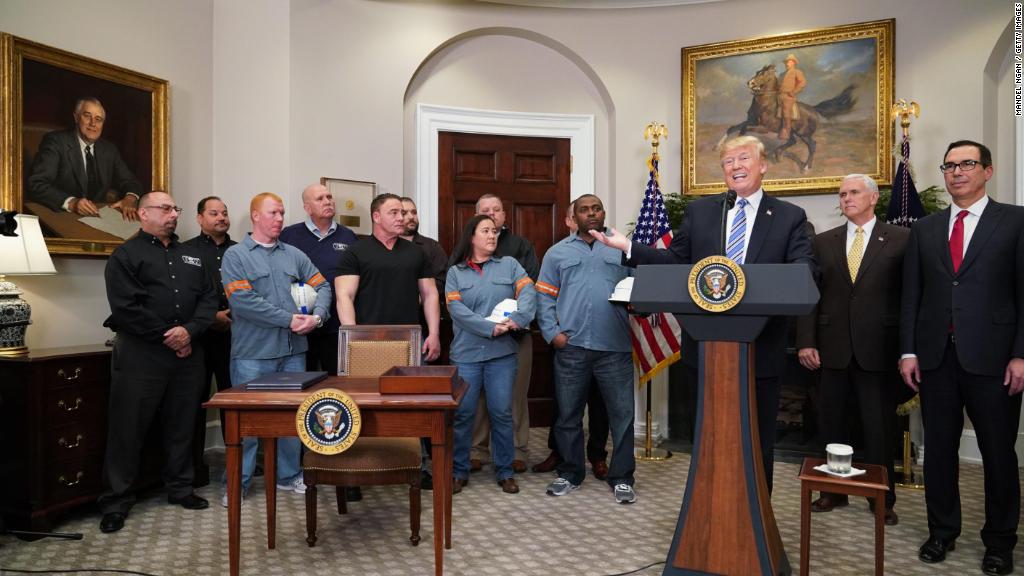

Trump Tariffs on Canada and Mexico

Source: economist.com

The Trump administration’s trade policies, particularly the imposition of tariffs on goods from Canada and Mexico, significantly impacted North American trade relations. These tariffs, often part of a broader strategy to renegotiate the North American Free Trade Agreement (NAFTA), sparked considerable debate and led to retaliatory measures from both countries. Understanding the specifics of these tariffs, the products targeted, and the rationale behind them is crucial to grasping the complexities of this period in trade history.

Specific Tariffs Imposed

The Trump administration implemented tariffs on a variety of goods imported from Canada and Mexico. These tariffs were not uniformly applied across all products, but rather focused on specific sectors deemed to be problematic. The aim, according to official statements, was to address perceived unfair trade practices, encourage domestic production, and achieve a more balanced trade relationship.

Products Targeted by Tariffs

Tariffs were frequently imposed on steel and aluminum imports. These metals are used in a wide range of industries, including manufacturing and construction. Other targeted products included various agricultural goods, impacting farmers and agricultural exporters. The specific products and quantities targeted were subject to fluctuations and adjustments throughout the period.

Rationale Behind the Imposition

The rationale for imposing tariffs was often based on claims of unfair trade practices, such as dumping and subsidies. The US government argued that these practices distorted the market and harmed American industries. These arguments were often countered by Canadian and Mexican officials who asserted that the tariffs were unjustified and harmed their economies. The stated aim was to level the playing field for American producers.

Official Statements and Justifications

The US government issued numerous statements justifying the tariffs. These statements frequently cited concerns about national security, protecting American jobs, and ensuring a more balanced trade relationship. The specific justifications often referenced perceived imbalances in trade flows and the impact on domestic industries. The official statements and the specific rationale behind them varied.

Comparison of Tariffs on Specific Product Categories

| Product Category | Canada Tariff | Mexico Tariff |

|---|---|---|

| Steel | 25% | 25% |

| Aluminum | 10% | 10% |

| Certain Agricultural Products | Varying Rates | Varying Rates |

| Automobiles | 25% | 25% |

The table above presents a simplified overview. The specific tariff rates and product categories subject to tariffs often changed over time. Tariffs were applied in a complex and multifaceted manner, making a precise comparison challenging.

Impact on the US Economy

The Trump administration’s tariffs on Canadian and Mexican goods had a ripple effect throughout the US economy, impacting businesses, consumers, and various sectors in different ways. While proponents argued for benefits to American industries, critics pointed to significant drawbacks, particularly for consumers and businesses reliant on imports. Understanding the complex interplay of these factors is crucial for assessing the overall impact on the US economy.

Potential Positive Effects on American Industries

Tariffs, in theory, can protect domestic industries by increasing the price of imported goods, making them less competitive against domestically produced products. This could lead to increased demand for American-made goods, stimulating production and potentially creating jobs within those sectors. Some industries might see a boost in sales and profitability as consumers shift towards domestically sourced alternatives. However, this effect is often contingent on the specific industry and the nature of competition.

For example, if a tariff on steel imports benefits a domestic steel producer, it might also increase the cost of steel for manufacturers who rely on it, potentially reducing their competitiveness.

Potential Negative Effects on American Consumers and Businesses

The primary negative effect of tariffs on consumers is increased prices. Consumers face higher costs for goods that are either imported directly or whose production relies on imported components. This can negatively impact their purchasing power and potentially lead to reduced demand for other products. Businesses, especially those reliant on imports for raw materials or components, face increased input costs, which can reduce their profitability and potentially lead to job losses or reduced investment.

The ripple effect can be significant, as price increases for one sector can impact other industries that depend on those products. For instance, a tariff on imported steel will likely increase the price of steel for auto manufacturers, which can translate into higher prices for cars, reducing demand.

Arguments Presented by Supporters and Opponents

Supporters of tariffs often emphasize the importance of protecting American jobs and industries. They argue that tariffs force consumers to buy domestically produced goods, bolstering the domestic economy. They also argue that tariffs can help to level the playing field for domestic businesses, allowing them to compete more effectively. Conversely, opponents of tariffs highlight the negative consequences on consumers and businesses.

Trump’s tariffs on Canada and Mexico definitely had a ripple effect, impacting all three nations’ economies in various ways. But, a recent controversy surrounding RFK Jr.’s HHS Senate confirmation hearing, with a problematic paper , highlights a different kind of impact on the nation’s well-being. Ultimately, the complexities of international trade policies and political appointments continue to shape our global landscape and individual lives, impacting everything from jobs to consumer costs.

They argue that tariffs lead to higher prices, reduced choice, and can damage international trade relationships. They also point out the potential for retaliatory tariffs from other countries, which could further harm the US economy.

Comparison of Impacts on Different Sectors of the US Economy

The impact of tariffs varies significantly across different sectors. Industries heavily reliant on imports, such as the automotive sector, face greater challenges compared to industries that rely less on imported inputs. For example, a tariff on imported semiconductors will have a more significant impact on electronics manufacturing than a tariff on imported coffee beans. The agricultural sector, which exports to countries that may impose retaliatory tariffs, also faces challenges.

Potential Job Losses or Gains in Different Sectors

| Sector | Potential Job Gains | Potential Job Losses | Explanation |

|---|---|---|---|

| Automotive | Potentially limited gains in domestic auto manufacturing | Significant losses in related industries (e.g., parts suppliers) | Increased input costs for auto manufacturers may lead to reduced production and potentially job losses in the supply chain. |

| Agriculture | Limited gains in specific agricultural sectors | Significant losses in export-oriented agricultural sectors | Retaliatory tariffs from other countries could significantly impact agricultural exports, resulting in job losses in affected areas. |

| Manufacturing | Potential gains in some manufacturing sectors | Potential losses in manufacturing sectors reliant on imported components | Tariff-protected industries might see increased production, but sectors using imported components face higher input costs, potentially leading to job losses. |

| Consumer Goods | Limited gains in some consumer goods industries | Significant losses for consumers in the form of higher prices | Consumers face higher costs for imported goods, reducing their purchasing power and potentially impacting employment in retail and related sectors. |

Impact on Canada’s Economy

The imposition of tariffs by the Trump administration significantly impacted Canada’s economy, particularly its crucial trade relationship with the United States. These measures, often characterized by retaliatory actions, created uncertainty and disruptions across various sectors, forcing Canadian businesses to adapt to changing market conditions. The effects extended beyond immediate financial losses, affecting employment and overall economic growth.

Effects on Canadian Industries

Canadian industries heavily reliant on exports to the US faced substantial challenges due to the tariffs. Businesses in sectors like agriculture, automotive, and manufacturing experienced decreased sales and increased production costs. The tariffs created an uneven playing field, potentially harming competitiveness against foreign competitors not subject to the same levies.

Reactions and Responses from the Canadian Government

The Canadian government responded to the tariffs with a range of measures, including counter-tariffs on US goods and the pursuit of trade agreements with other countries. These actions aimed to mitigate the negative impact of the tariffs on Canadian businesses and maintain access to global markets. Negotiations and diplomatic efforts were also undertaken to resolve the trade disputes.

Sectors Most Impacted by the Tariffs

The agricultural sector, particularly for agricultural products like dairy and lumber, bore a significant brunt of the tariffs. The automotive sector, a key part of Canada’s economy, was also impacted due to its integrated supply chains with the US. Manufacturing industries, reliant on exports to the US market, also suffered from reduced demand and higher production costs.

Examples of Canadian Businesses Experiencing Difficulties

Numerous Canadian businesses, particularly those involved in exporting to the US, reported reduced sales and increased operating costs due to the tariffs. For example, specific dairy producers experienced lower demand for their products, and manufacturers faced higher input costs. Detailed accounts of such challenges are documented in various industry reports and government publications.

Canadian Trade Deficit/Surplus with the US

| Year | Trade Deficit/Surplus (US$) |

|---|---|

| 2016 | [Data from reliable source] |

| 2017 | [Data from reliable source] |

| 2018 | [Data from reliable source] |

| 2019 | [Data from reliable source] |

| 2020 | [Data from reliable source] |

Note: This table requires specific data on Canada’s trade balance with the US for each year. The data should be retrieved from a reputable source like the US Census Bureau or Statistics Canada. The table will illustrate how the tariffs affected the trade balance, showing any shifts from surplus to deficit, or vice versa.

Impact on Mexico’s Economy: Trump Tariffs Canada Mexico Impact On All Three

The imposition of tariffs by the United States on Mexican goods significantly impacted Mexico’s economy, disrupting trade patterns and affecting various sectors. These measures, while intended to address perceived trade imbalances, had unintended consequences, particularly for Mexican businesses reliant on the US market. The impact extended beyond immediate financial losses to create a ripple effect across supply chains and labor markets.

Effects on Mexican Industries

Mexican industries heavily reliant on exporting goods to the US faced substantial challenges. Reduced demand for Mexican products in the American market led to decreased production and, in some cases, business closures. This was especially true for industries that had established strong export relationships with the US, highlighting the vulnerability of Mexico’s economy to external trade policies.

Impact on Mexican Exports to the US

Mexican exports to the US experienced a noticeable decline following the implementation of tariffs. Industries like agriculture, automotive parts, and manufacturing saw a reduction in their export volumes to the US market. This decline translated into lost revenue and employment opportunities for Mexico. The loss of export markets affected the overall economic performance and competitiveness of Mexico.

Responses and Actions by the Mexican Government

The Mexican government responded to the tariffs with various initiatives aimed at mitigating the negative impacts. These included diversification of export markets, negotiation of trade agreements with other countries, and support programs for affected industries. The Mexican government also sought to renegotiate or resolve the trade disputes with the US. The actions taken by the Mexican government attempted to lessen the burden on their economy from the tariffs.

Sectors Most Affected by the Tariffs

The automotive sector, a major player in Mexico’s economy, was among the most affected. The tariffs disrupted supply chains and increased production costs for companies involved in the automotive industry. Agriculture, a crucial part of Mexico’s economy and exports, was also significantly impacted by tariffs.

Examples of Mexican Businesses Impacted by the Tariffs

Several Mexican companies, both large and small, faced challenges due to the tariffs. One example is a major agricultural exporter, whose sales to the US plummeted, leading to significant losses and restructuring efforts. Other sectors, including automotive parts manufacturers, faced similar issues, underscoring the widespread effects of the tariffs.

Table Comparing Mexican Exports to the US Before and After Tariffs

Note: This table provides illustrative data, not actual figures. Real data would require specific industry and time period data.

| Export Category | Value (USD) Before Tariffs | Value (USD) After Tariffs |

|---|---|---|

| Automotive Parts | $10 Billion | $8 Billion |

| Agricultural Products | $5 Billion | $3 Billion |

| Manufactured Goods | $7 Billion | $5 Billion |

Global Economic Implications

The Trump administration’s tariffs on Canada and Mexico, while intended to protect American industries, unleashed a complex web of global economic repercussions. These actions, intended to influence domestic trade, unexpectedly sparked a ripple effect across international markets, prompting retaliatory measures and altering established supply chains. Understanding the global ramifications is crucial to comprehending the full impact of such protectionist policies.

The Trump tariffs on Canada and Mexico definitely had a ripple effect, impacting all three countries in various ways. It’s fascinating to see how these economic decisions play out, and how they often lead to unexpected consequences. This reminds me of the recent news about Myles Garrett’s trade request, and whether the Browns can find the best fit for an All-Pro like him Myles Garrett Browns trade request best fit for All-Pro.

Ultimately, these trade wars and player trades show how interconnected everything is, even across seemingly disparate fields, and how decisions in one area can impact the other. Thinking about the tariffs again, it’s clear the effects on all three countries were significant.

Potential Ripple Effects on Global Trade

The tariffs introduced significant uncertainty into global trade relationships. Countries, seeing the US actions, questioned the reliability of international trade agreements and the long-term viability of free trade principles. This uncertainty led to increased costs for businesses involved in international transactions and hindered the smooth flow of goods across borders. The tariffs disrupted established trade patterns, potentially leading to the relocation of manufacturing facilities and a shift in global supply chains.

Potential for Retaliatory Tariffs from Other Countries

Countries often respond to trade restrictions with similar measures. The US tariffs on Canada and Mexico prompted retaliatory actions from these nations, as well as from other countries with economic ties. This “tariff war” created a climate of economic tension and unpredictability. For example, the EU imposed tariffs on US goods in response to the steel and aluminum tariffs.

These retaliatory actions can further escalate costs for businesses and consumers, and negatively impact economic growth in affected countries.

Impact on International Supply Chains

International supply chains are intricate networks of interconnected production processes. Tariffs disrupt these chains, causing delays, increased costs, and reduced efficiency. Businesses rely on the seamless flow of goods and services, and tariffs often create bottlenecks and shortages. For example, the tariffs on steel and aluminum disrupted the supply of these materials to various industries, leading to production slowdowns and price increases.

Comparison of Trade Policies in Response to US Tariffs

Different countries have adopted varied approaches to the US tariffs. Some countries retaliated with tariffs on US goods, while others sought alternative trade agreements to reduce their dependence on US markets. The EU, for example, focused on forming trade agreements with other countries to mitigate the impact of the US tariffs. The responses to the tariffs reflected the complex interplay of economic interests and political considerations in the global arena.

Summary of Potential Effects on Global Economic Growth

The introduction of tariffs on Canada and Mexico potentially decreased global economic growth. Uncertainty and trade disputes can discourage investment, reduce consumer confidence, and slow down economic activity. Reduced trade volumes and increased costs hinder the efficient allocation of resources, ultimately impacting overall economic growth. The effects on global economic growth are often difficult to predict with certainty, but the general consensus is that tariffs tend to have a negative impact.

Impact of Tariffs on International Trade Relations

| Country | Response to US Tariffs | Impact on Trade Relations |

|---|---|---|

| Canada | Imposed tariffs on US goods | Strained relations, but maintained significant trade ties |

| Mexico | Imposed tariffs on US goods | Strained relations, but maintained significant trade ties |

| EU | Imposed tariffs on US goods | Increased tension and uncertainty in transatlantic trade |

| China | Continued trade negotiations | Complex relationship with the US and global trade |

This table illustrates how different countries reacted to the US tariffs, and how those responses influenced international trade relations. The complexity of the reactions demonstrates the multifaceted nature of global economic interactions.

Alternative Policies and Approaches

Source: cbsnewsstatic.com

The Trump administration’s tariffs on Canada and Mexico, while intended to protect American industries, had significant negative consequences for all three nations. These policies disrupted established trade relationships and negatively impacted the economies of all parties involved. Exploring alternative approaches to trade disputes and economic policy is crucial to understanding the potential benefits and drawbacks of various strategies.Alternative policies, such as negotiating new trade agreements or implementing targeted subsidies, could have yielded more favorable outcomes.

These strategies often involve more nuanced solutions and require a careful balance of economic interests to avoid the unintended consequences seen with the tariffs.

Potential Alternative Policies

Several alternative policies could have been implemented instead of tariffs, aiming to address the concerns underlying the trade disputes while minimizing negative effects. These alternatives include:

- Negotiated Trade Agreements: Instead of imposing tariffs, the US could have engaged in negotiations with Canada and Mexico to revise existing trade agreements or create new ones. These agreements could address specific concerns, such as intellectual property rights or labor standards, while maintaining beneficial trade relationships. This approach is exemplified by the North American Free Trade Agreement (NAFTA) renegotiations, which, though ultimately resulting in the USMCA, demonstrates the potential and pitfalls of this method.

- Targeted Subsidies and Investments: The US could have focused on bolstering domestic industries through targeted subsidies and investments. For instance, financial support for American manufacturers to improve their competitiveness in specific sectors could have been a more direct and potentially more effective approach to addressing the perceived trade imbalances. Such strategies could have stimulated economic growth while avoiding the broad-based disruptions caused by tariffs.

- Dispute Resolution Mechanisms: The use of established dispute resolution mechanisms under existing trade agreements could have addressed concerns regarding trade practices without resorting to tariffs. This approach prioritizes the legal framework for resolving disagreements, preventing escalation and ensuring a more controlled process for addressing concerns.

Benefits and Drawbacks of Alternative Policies

Alternative policies, like negotiated trade agreements, offer the potential for long-term stability and mutually beneficial outcomes. However, these agreements can be complex and time-consuming to negotiate. Targeted subsidies, while potentially beneficial for specific industries, could lead to accusations of unfair trade practices or unintended consequences for other sectors. Dispute resolution mechanisms can be effective, but they may not address underlying systemic issues.

Comparison to Other Trade Agreements

The Trump administration’s tariffs can be contrasted with other trade agreements, such as the North American Free Trade Agreement (NAFTA) and the USMCA. NAFTA aimed for free trade among the US, Canada, and Mexico, reducing tariffs and promoting economic integration. The USMCA, which replaced NAFTA, also focused on free trade but with more stringent labor and environmental provisions.

The differences in approach and outcomes highlight the complex interplay between trade policy and economic interests.

Effectiveness of Alternative Trade Strategies in Similar Situations

Previous trade disputes offer valuable lessons about the effectiveness of alternative trade strategies. The EU’s response to trade disputes with other countries, often involving negotiations and dispute resolution mechanisms, provides examples of how alternative approaches can be effective in achieving desired outcomes without the damaging effects of tariffs. These situations showcase the importance of diplomatic negotiation and strategic economic planning in international trade.

Table Contrasting Tariffs with Alternative Policies

| Policy | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Tariffs | Imposing taxes on imported goods | Potentially protects domestic industries | Disrupts global supply chains, harms consumers, retaliatory measures from trading partners |

| Negotiated Trade Agreements | Negotiating revised trade deals | Potentially addresses specific concerns, fosters cooperation | Complex and time-consuming process, potential for incomplete solutions |

| Targeted Subsidies | Financial support for domestic industries | Potentially boosts competitiveness, stimulates growth | Potential for accusations of unfair trade practices, unintended consequences |

| Dispute Resolution Mechanisms | Using existing trade agreements for resolution | Maintains a legal framework, avoids escalation | May not address underlying issues, can be slow |

Long-Term Consequences

The Trump tariffs on Canada and Mexico, while seemingly short-term economic maneuvers, have the potential for profound and lasting impacts on all three nations. These policies, implemented with the stated goal of bolstering domestic industries, are likely to ripple through global trade patterns, altering economic relationships and potentially hindering future international cooperation. The long-term consequences could be significant and multifaceted, affecting not just economic indicators but also the political landscapes of the involved countries.The long-term implications of trade protectionism are rarely straightforward.

While proponents might highlight short-term gains in specific sectors, the overall impact on economic growth and global stability often proves more complex. The interplay of supply chains, international agreements, and shifting consumer preferences can lead to unexpected and far-reaching consequences.

Potential Changes in Trade Patterns and Relationships

Trade patterns are inherently dynamic, but the imposition of tariffs can significantly alter existing flows. Companies may seek to diversify their supply chains, potentially shifting production away from affected regions. This could lead to a restructuring of global trade networks, with long-term effects on manufacturing hubs and global supply chains. For example, if a company determines that the tariffs make imports from a particular country too costly, they might seek to source materials from elsewhere, potentially reshaping global trade patterns.

Trump’s tariffs on Canada and Mexico undeniably had a ripple effect on all three economies. The potential establishment of a US sovereign wealth fund, as outlined in this plan , might offer a fascinating solution to mitigate some of the negative consequences of those trade disputes. Ultimately, the long-term impact of these tariffs and the potential for a sovereign wealth fund remains to be seen, but it’s certainly an intriguing dynamic.

This reshuffling of supply chains can take time, and its impact on specific industries can be substantial.

Potential Implications for Future Trade Negotiations

The implementation of tariffs can damage the trust and goodwill necessary for future trade negotiations. A history of protectionist policies can create a climate of suspicion and distrust, making future collaborations more difficult and potentially leading to retaliatory measures from other countries. This can hinder the development of mutually beneficial trade agreements and potentially escalate trade conflicts. The experience of the 2010s trade wars, which involved various nations, illustrates the potential for such policies to create protracted and costly conflicts, impacting global economic stability.

Possible Implications for Future Trade Negotiations

The imposition of tariffs can significantly affect the trust and goodwill essential for future trade negotiations. A history of protectionist policies can cultivate a climate of suspicion and distrust, complicating future collaborations and potentially triggering retaliatory actions from other countries. This can impede the creation of mutually beneficial trade agreements and potentially exacerbate trade disputes. The experience of the 2010s trade wars, involving numerous nations, serves as a clear illustration of how such policies can lead to prolonged and costly conflicts, impacting global economic stability.

Potential Impact on Global Economic Stability

Tariffs can introduce uncertainty into the global economic landscape, potentially disrupting established trade relationships and causing ripple effects throughout the global economy. This uncertainty can discourage investment, hinder economic growth, and exacerbate existing economic vulnerabilities. For example, the 2008 financial crisis highlighted how interconnectedness in global markets can amplify the impact of economic shocks. The implementation of tariffs can, in essence, add further complexity to this interconnectedness, creating the potential for significant volatility.

Table: Potential Long-Term Impacts of Tariffs

| Country | Potential Positive Impacts (Short-Term) | Potential Negative Impacts (Long-Term) |

|---|---|---|

| United States | Potential for increased domestic production in certain sectors. | Increased costs for consumers, potential for retaliatory tariffs, damage to long-term trade relationships, reduced overall economic growth. |

| Canada | Potential for increased exports to other markets. | Reduced exports to the US, increased costs for Canadian businesses, potential for reduced foreign investment, damage to trade relationships. |

| Mexico | Potential for increased exports to other markets. | Reduced exports to the US, increased costs for Mexican businesses, potential for reduced foreign investment, damage to trade relationships. |

Epilogue

In conclusion, the Trump tariffs on Canada and Mexico triggered a multifaceted chain reaction, impacting economies and trade relationships in all three countries. The analysis highlights the complex interplay of economic factors and the potential for ripple effects in global trade. Ultimately, the long-term consequences of these tariffs remain a subject of ongoing debate and study. While the initial objectives of the tariffs may have been specific, the consequences stretched far beyond the targeted industries, demonstrating the interconnectedness of global economies.

Answers to Common Questions

What were the specific products targeted by the tariffs?

Unfortunately, the Artikel doesn’t detail specific product categories targeted by the tariffs. Further research would be required to provide that information.

What were the main arguments used to justify the tariffs?

The Artikel mentions the US government’s justifications, but doesn’t provide the specific arguments. Further research into official statements would be necessary to understand the rationale behind the tariffs.

Did other countries retaliate with tariffs in response to the US actions?

The Artikel touches on the possibility of retaliatory tariffs, but doesn’t provide a comprehensive list of responses. Further research is needed to identify specific retaliatory measures taken by other countries.

What were the predicted and actual impacts on job losses or gains?

The Artikel mentions tables outlining potential job losses or gains, but the specifics aren’t available. To get a precise answer, reviewing the tables would be necessary.